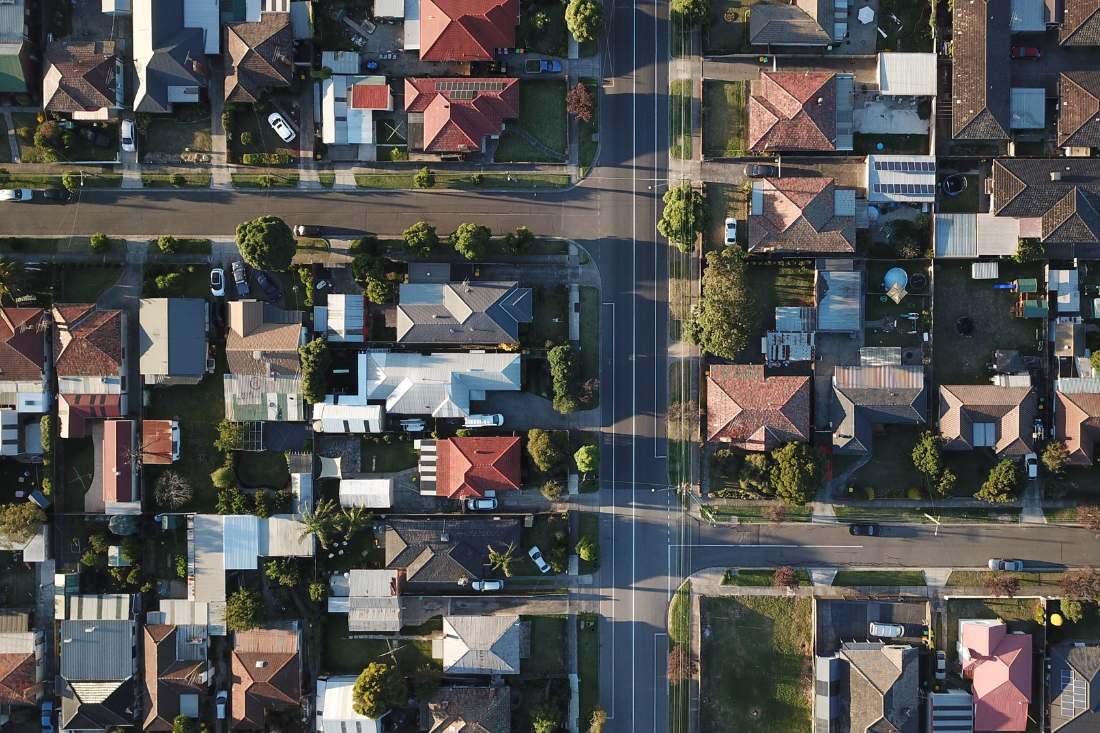

Are you dreaming of owning your own home in the land Down Under? Australia offers a vibrant real estate market with diverse opportunities, but diving into the world of home loans can be a bit overwhelming, especially for first-time buyers. Let’s shed some light on the key factors to consider.

Understanding the Australian Market: Australia’s real estate market is known for its stability and long-term growth potential. However, it’s crucial to research the specific area you’re interested in, as market conditions can vary significantly from city to city and even suburb to suburb.

Getting Your Finances in Order: Before you start house hunting, it’s wise to assess your financial situation. A healthy credit score and a clear understanding of your budget are essential. Lenders in Australia typically require a deposit, so saving up for this initial amount is a significant first step.

Exploring Home Loan Options: Australia offers a range of home loan options, including fixed-rate and variable-rate mortgages. Each has its advantages, so it’s essential to consider your financial goals and risk tolerance when choosing the right one for you. Additionally, government initiatives, such as the First Home Owner Grant, can provide valuable assistance to eligible buyers.

The Application Process: When you’ve chosen a lender and a loan product that suits your needs, the application process begins. Be prepared to provide documentation about your financial situation, employment history, and the property you intend to purchase. Working with a mortgage broker can simplify this process and increase your chances of approval.

Closing the Deal: Once your home loan is approved, you’ll be one step closer to owning your dream home. But remember, buying a home involves more than just the purchase price. Factor in additional costs like stamp duty, legal fees, and insurance.

Navigating the home loan process in Australia can seem daunting, but with the right knowledge and guidance, you can make informed decisions and take confident steps toward achieving your homeownership dreams. Stay tuned for more insights and tips on the Australian real estate market right here on our blog.