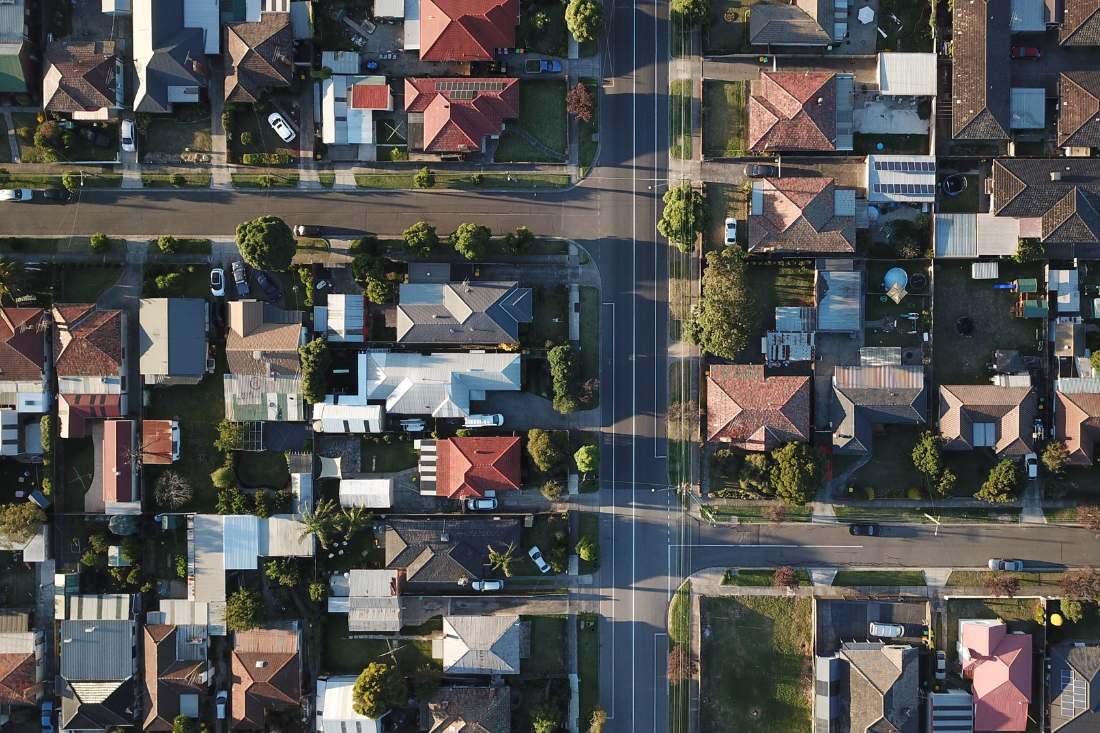

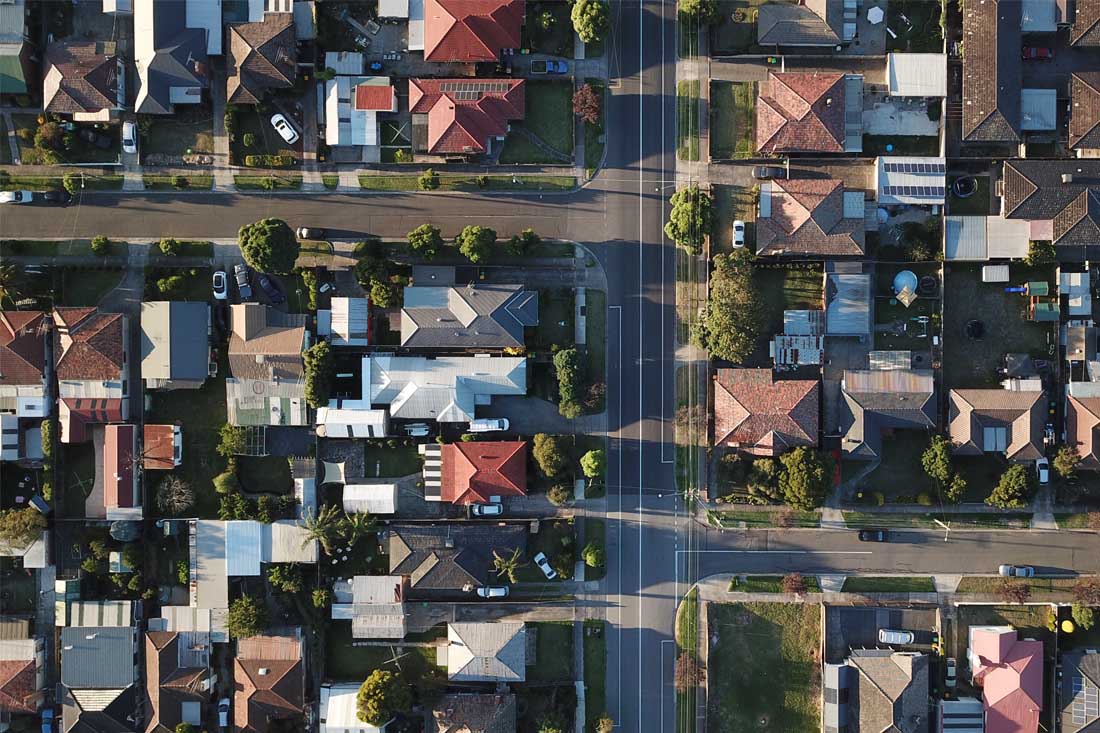

Investing in property is a time-tested strategy for building wealth in Australia, offering potential financial stability and long-term growth. Whether you’re a seasoned investor or just starting, here are some valuable tips to help you navigate the Australian property market effectively.

1. Define Your Investment Goals: Before diving in, clarify your investment objectives. Are you seeking rental income, long-term capital growth, or a combination of both? Having clear goals will guide your property selection and strategy.

2. Research the Market: Australia’s property market is diverse, with conditions varying from city to city and suburb to suburb. Conduct thorough research to identify areas with potential for growth and rental demand. Consider factors like infrastructure development, employment opportunities, and local amenities.

3. Set a Budget: Establish a realistic budget that takes into account your financial capacity, borrowing potential, and ongoing expenses. Don’t forget to factor in additional costs like stamp duty, legal fees, and property management expenses.

4. Choose the Right Property: Select properties that align with your investment goals. Consider factors like property type (apartment, house, or commercial), location, and condition. A property inspection is crucial to assess its condition and potential for renovations or improvements.

5. Financing and Loan Structure: Explore financing options and loan structures that suit your investment strategy. Variable or fixed-rate loans, interest-only or principal and interest repayment methods – each has its advantages and risks. Consult a mortgage expert for tailored advice.

6. Consider Tax Implications: Understand the tax implications of property investment, including capital gains tax (CGT) and negative gearing. Seek advice from a tax professional to optimize your financial position.

7. Property Management: If you plan to rent out your property, engage a reputable property management company or consider self-management. Proper property management ensures your investment remains attractive to tenants and well-maintained.

8. Stay Informed: Keep yourself updated on changes in property regulations, interest rates, and market trends. Knowledge is a valuable asset in property investment.

9. Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversifying your property portfolio across different types of properties and locations can mitigate risks.

10. Long-Term Perspective: Property investment often yields significant returns over the long term. Be patient and avoid making impulsive decisions based on short-term market fluctuations.

Remember that property investment is a substantial financial commitment. Seek advice from financial advisors, real estate professionals, and mortgage experts to make informed decisions. By following these tips and building a well-thought-out investment strategy, you can work towards achieving your wealth-building goals in the Australian property market.