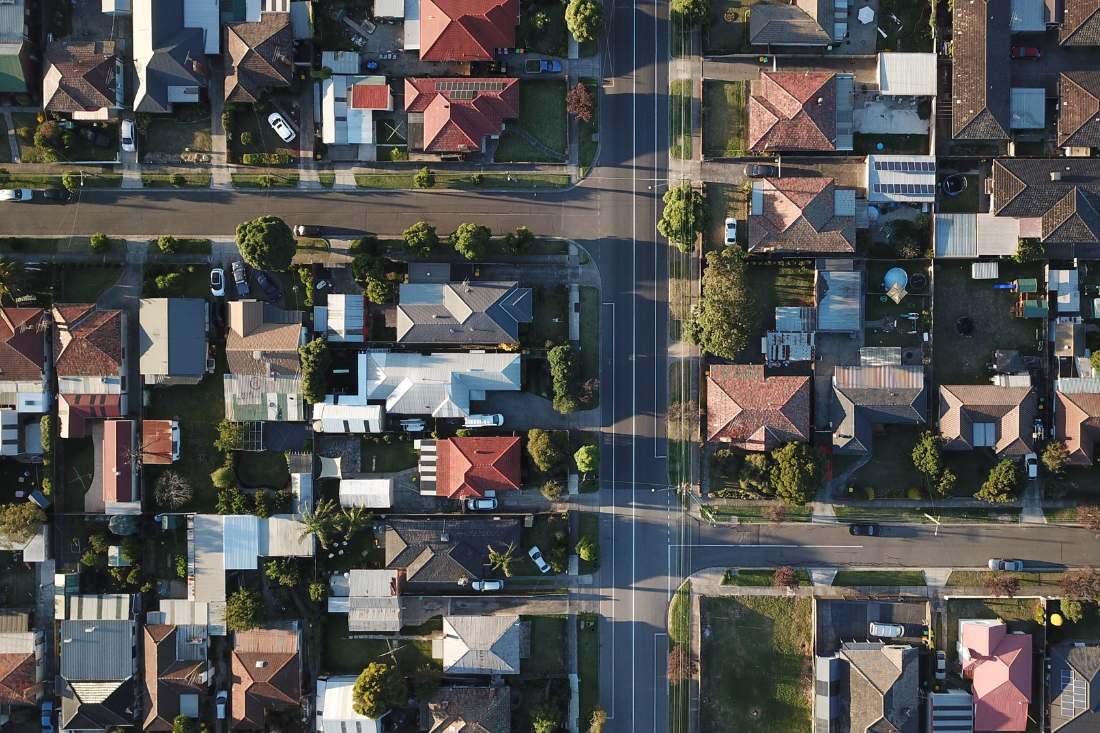

The decision between buying and renting a home is one of the most significant financial choices you’ll make. In Australia’s dynamic real estate market, both options have their advantages and considerations. Let’s explore the key factors to help you make an informed housing decision that aligns with your lifestyle and financial goals.

Buying a Home:

Pros:

- Long-Term Investment: Owning a home can build wealth through property appreciation over time.

- Stability: You have the freedom to personalize and make long-term plans for your home.

- Mortgage Payments: While initial costs may be high, mortgage payments contribute to property ownership.

- Tax Benefits: Australia offers various tax benefits for homeowners, including exemptions and deductions.

Cons:

- Upfront Costs: Buying a home requires a substantial deposit, stamp duty, and legal fees.

- Maintenance: As a homeowner, you are responsible for property maintenance and repair costs.

- Fixed Location: Owning a home ties you to a specific location, which may limit flexibility.

Renting a Home:

Pros:

- Financial Flexibility: Renting typically involves lower initial costs, making it accessible for many.

- Maintenance: Property maintenance and repair costs are typically the landlord’s responsibility.

- Location Flexibility: Renting allows you to explore different areas and easily relocate.

- Investment Opportunities: You can invest your savings elsewhere, potentially yielding higher returns.

Cons:

- Limited Control: Renters have limited control over property customization and long-term stability.

- No Equity Buildup: Rent payments do not contribute to property ownership or equity.

- Market Fluctuations: Rents may increase over time, impacting your long-term financial planning.

Factors to Consider:

- Financial Situation: Evaluate your financial capacity, including savings and ongoing expenses.

- Long-Term Goals: Consider your long-term housing and financial goals.

- Market Conditions: Research local property market conditions, including rental costs and property prices.

- Lifestyle Preferences: Assess your lifestyle preferences, such as stability, customization, and location flexibility.

Conclusion:

The decision between buying and renting hinges on your individual circumstances and priorities. If you seek long-term stability, property ownership, and potential wealth building, buying may be the right choice. However, if flexibility, lower upfront costs, and investment diversity are your priorities, renting could be more suitable.

Ultimately, there is no one-size-fits-all answer. Consult with financial advisors and consider your unique financial situation and lifestyle preferences when making your housing decision in Australia’s dynamic real estate market.